Explore Our Commercial Credit Reports

Comprehensive Insights for Your Business

At Credit Bridge, we specialize in providing detailed commercial credit reports, sourced from the top four major credit bureaus. Understand the strengths and weaknesses of your business credit profile and learn actionable steps to enhance your financial standing.

Explore Our Key Features

Comprehensive Credit Scores

In-Depth Credit Reports

Credit Education Services

Strategic Credit Planning

Develop a robust credit strategy with our personalized consulting services, ensuring your business maximizes its financial potential.

Understanding Commercial Credit Reports

Commercial credit reports are vital tools for businesses, providing a snapshot of a company’s creditworthiness. These reports, compiled from data collected by major credit bureaus, help lenders, suppliers, and business partners make informed decisions. A detailed and accurate commercial credit report can influence financial terms, affect credit limits, and open up new opportunities for growth and collaboration.

Accuracy in these reports is paramount; even minor discrepancies can skew a company’s financial image, leading to higher interest rates or reduced credit terms. Therefore, businesses must ensure their financial activities are well-documented and updated regularly in these reports to maintain a favorable credit standing.

At CreditBridgePro, we emphasize the importance of understanding the different sections of a commercial credit report. Recognizing areas that reflect positively on your business, as well as those that may need improvement, is crucial. A comprehensive review can reveal patterns in payment behaviors, outstanding debts, and company stability, which are all key factors in assessing a business’s financial health.

Moreover, taking proactive steps based on the insights provided by these reports can significantly enhance a company’s credit profile. Implementing strategic financial management, resolving derogatory marks, and consistently monitoring your credit status are essential actions that lead to better credit opportunities and business growth.

Understanding Major Commercial Credit Bureaus

Commercial credit bureaus play a pivotal role in shaping the financial landscape for businesses by providing detailed credit reports. These bureaus, including Dun & Bradstreet, Equifax Business, Experian Business, and TransUnion Business, collect and analyze vast amounts of financial data to help lenders, suppliers, and other creditors assess the creditworthiness of a business. Each bureau has its unique methodologies and scoring systems, which can significantly impact a business’s ability to secure financing, negotiate payment terms, and manage financial risks effectively.

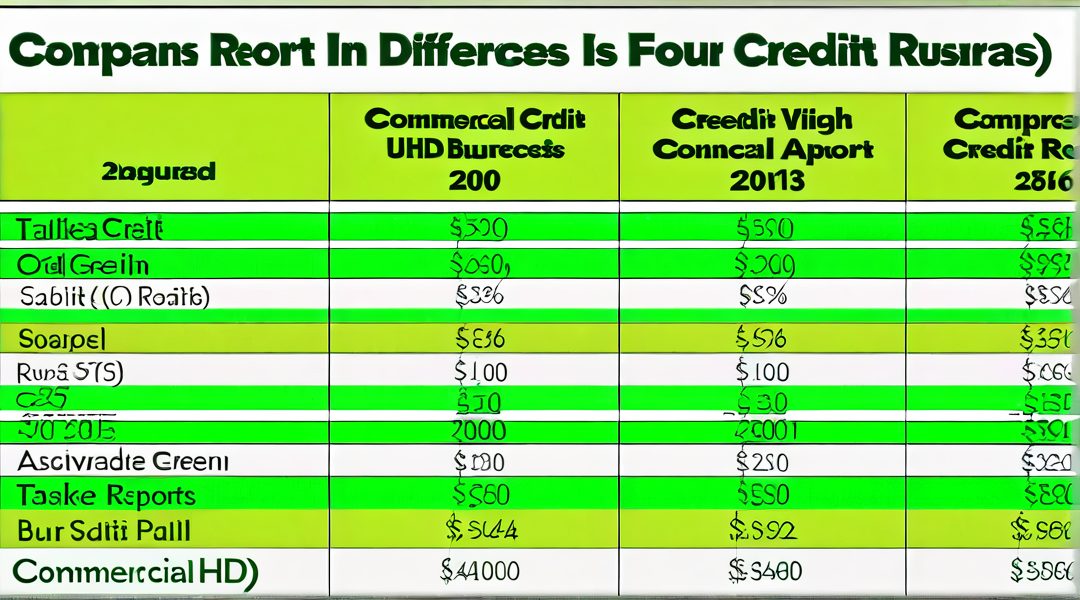

Comparing Commercial Credit Reports

Equifax Business

Equifax provides comprehensive credit reports that include detailed payment histories and risk scores, helping businesses assess creditworthiness.

Depth of Credit History

Risk Score Analysis

Payment Index

Public Record Insights

Experian Business

Experian offers robust profiling of businesses with an emphasis on credit utilization and outstanding debts, ideal for precise credit management.

Credit Utilization Focus

Debt Analysis

Business Credit Score

Fraud Detection Services

1

Understanding Your Commercial Credit Report

2

Identify Positive Credit Factors

3

Spot Derogatory Marks

Unlock Your Business's Credit Potential

Don’t let uncertainties dictate your business decisions. Contact CreditBridgePro now to obtain comprehensive commercial credit reports or to discuss strategies for enhancing your credit profile. Take the first step towards financial clarity and empowerment.